Everything Centers Around Medicare Parts A & B!

It is very common for people to be confused by Original Medicare. The easiest way to understand Medicare is to understand the different parts of Original Medicare.

Medicare Parts A & B can be looked at as the centerpieces that everything else revolves around. They are the only two pieces that actually come from the government. All other parts you hear about come from private insurance companies

What Is Medicare Part-A?

Medicare Part-B is (for the most part) going to include your outpatient services. These can be described as doctors visits, outpatient surgeries, lab work, outpatient x-rays, durable medical equipment (such as wheelchairs and oxygen tanks), ambulance services, amongst other things. Medicare Part-B is like the other side of the coin to Medicare Part-A. What Part-A does not cover on the medical side, Part-B typically does.

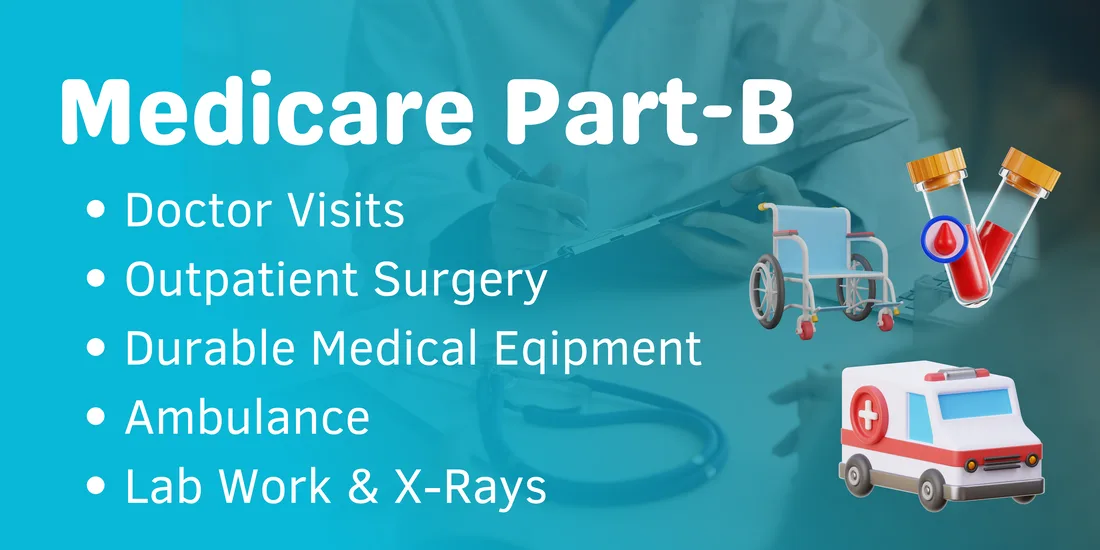

What Is Medicare Part-B?

Medicare Part-B is (for the most part) going to include your outpatient services. These can be described as doctors visits, outpatient surgeries, lab work, outpatient x-rays, durable medical equipment (such as wheelchairs and oxygen tanks), ambulance services, amongst other things. Medicare Part-B is like the other side of the coin to Medicare Part-A. What Part-A does not cover on the medical side, Part-B typically does.

What Does Original Medicare Not Cover?

What does Original Medicare not cover? Plenty! Original Medicare on its own does not cover prescription drugs that would be filled at a pharmacy. It does not cover things like dental, vision, or hearing. Believe it or not, Original Medicare does not cover a traditional physical after you have been on Original Medicare longer than 12 months. Original Medicare provides you with a “Welcome to Medicare” physical in the first year of being an Original Medicare recipient, but after that never again. Original Medicare covers what is known as a Wellness visit, but it is best described as a less detailed physical.

Hours of Operation

MON – FRI

9:30am – 5:00pm

SAT & SUN

We are closed