What is a Medigap? (Medicare Supplement)

Medigap plans (also known as Medicare Supplement plans) have been around for a long time. These are the types of plans we hear so many tell us, “I think that is what my parents had!” Medigaps have changed quite a bit over the last 20+ years, but the basic principle remains the same. Medicare Supplement plans pay as a secondary insurance after Medicare has paid. Medicare pays 80% of a person’s medical bills, and the Medicare Supplement plan (purchased through a private insurance company) comes in and pays afterward.

The rules are simple: as long as Medicare pays first on a claim, the Medicare Supplement will pay afterward. On the flip side, if Medicare does not cover something, neither will the Medicare Supplement plan. This means that since Medicare does not cover things like Part-D prescription drugs, dental, vision, and hearing, neither will the Medicare Supplement plan. These things must be picked up separately in the forms of Part-D prescription drug plans and Dental, Vision and Hearing plans.

What Kinds Of Medigap Plans Exist?

Medicare Supplement plans are designed by Medicare and then given to private insurance companies to market. This means that the insurance company has actually no say in what the coverage will look like. They take the plans as they are. The two things that the insurance company does control is how much they will charge for monthly premiums and what the rate increases will be going forward.

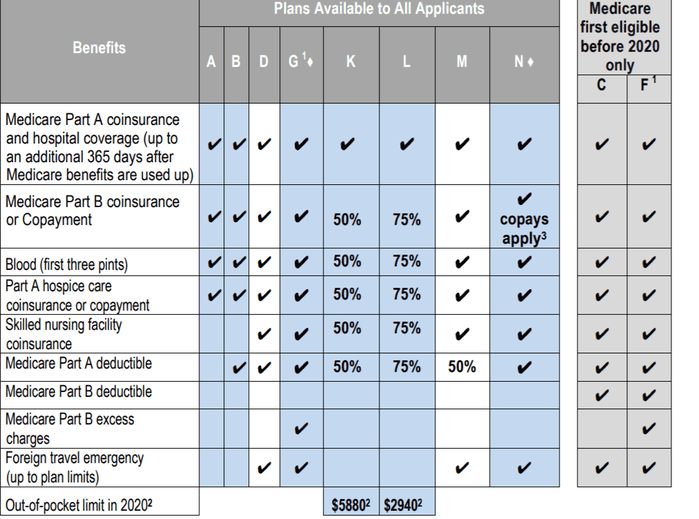

So the answer to what you’ve been thinking is… YES! Every insurance company that offers Medicare supplement plans offer the same coverage, just for different prices. The Medicare Supplement plans are designed based on what they will cover depending how much Medicare leaves behind. They are all named after letters. The most popular Medicare Supplement plans on the market today are by far the Plan G and the Plan N. Here is a chart of the available plans below.

What Plans Are Good?

Today and going forward, it is all about Plans G and N. Plans F and C are no longer able to be purchased due to the MACRA bill that took effect on January 1, 2020. The bill states that any person who was eligible for Medicare before January 1st of 2020 will still have the option of purchasing a Plan F or Plan C with any insurance company. Plan G is the closest thing to Plan F with it only leaving behind the Medicare Part-B deductible which is charged once per year.

The Plan N also charges this Medicare-Part B deductible, but it also does not cover what is known as Medicare Part-B excess charges. It also charges up to a $20 copay for each doctor visit and a $50 copay for an emergency room visit. The appeal of Plans G and N over a Plan F (even before it was grandfathered away) was they both are much cheaper in terms of monthly premium, with N being cheaper than F and G in most areas.

Hours of Operation

MON – FRI

9:30am – 5:00pm

SAT & SUN

We are closed